Why Estate Planning Requires More Than One Perspective

Estate planning isn’t just about documents it’s about understanding how legal decisions intersect with taxes, business ownership, and long-term financial goals.

Coordinated tax and legal communication

Clear separation of professional engagements

Reduced confusion and rework

Planning built with future tax implications in mind

A Collaborative Services Team With Clear Roles

Our estate planning approach is built around collaboration, not bundled services. Clients engage separately with Cooper CPA Group and Ball PLLC, while benefiting from coordinated communication between professionals.

HOW WE FIT IN:

Cooper CPA Group

Tax Planning & Strategy

Estate and trust tax considerations

Business ownership and succession insights

Ongoing tax compliance support

Ball PLLC

Esate planning document preparation

Wills, trusts, and related legal instruments

Trust administration guidance

Legal execution and signing

A Conversation on Estate Planning & Tax Strategy

Hear directly from our services team as they discuss how coordinated estate planning works, what clients can expect, and why clarity throughout the process matters.

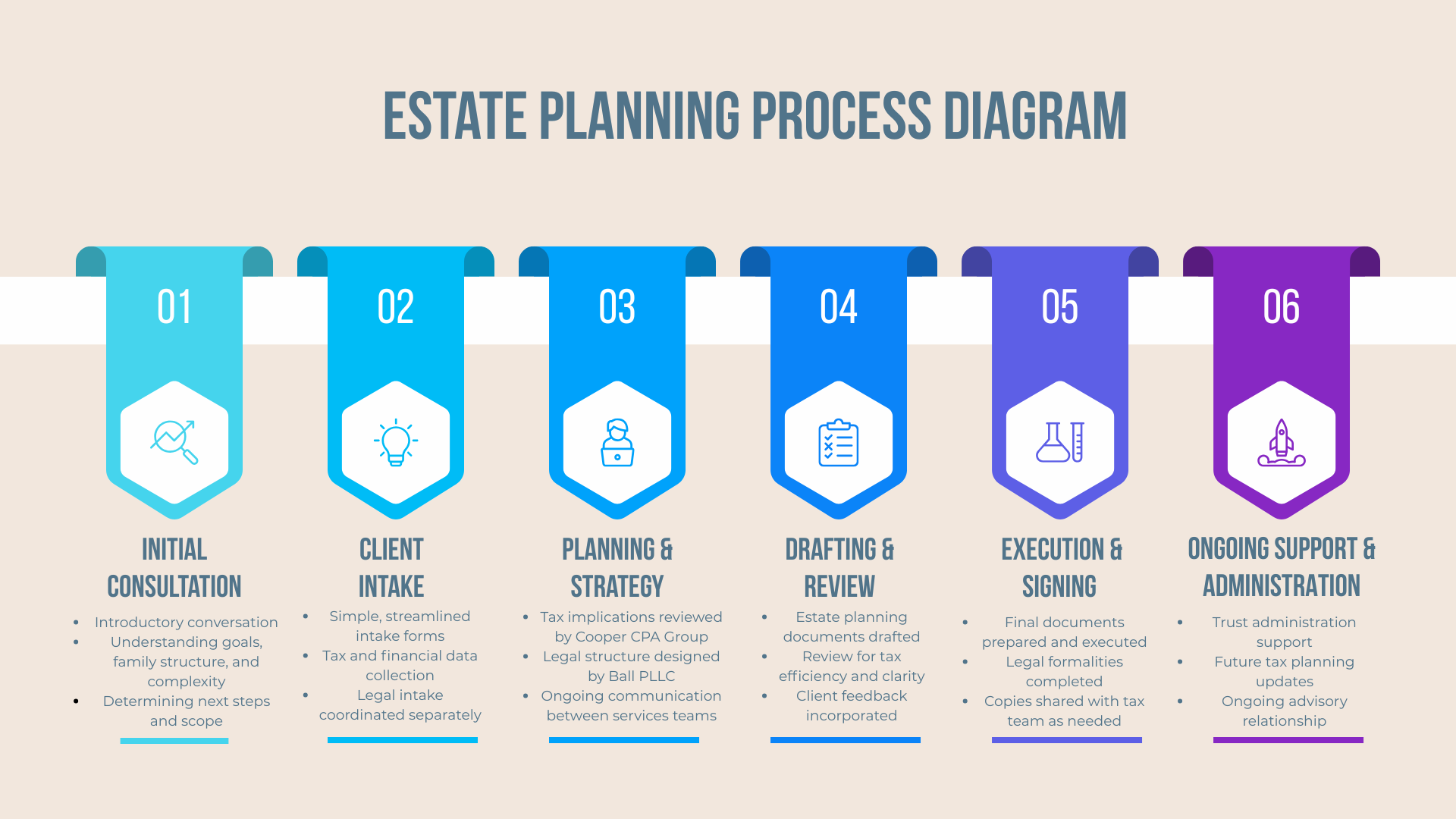

Your Estate Planning Journey — Step by Step

A clear, guided process that walks you through each stage of estate planning, with defined handoffs and coordinated communication across your services team.

Initial Consultation + Client Intake

Introductory conversation

Understanding goals, family structure, and complexity

Simple, streamlined intake forms

Tax & financial data collection

Planning & Strategy + Drafting & Review

Tax implications reviewed by Cooper CPA Group

Legal structure designed by Ball PLLC

Estate planning documents drafted

Review for tax efficiency & clarity

Execution & Signing + Ongoing Support

Final documents prepared and executed

Legal formalities completed

Trust administration support

Ongoing advisory relationship

Meet Your Estate Planning Service Team

GARY COOPER, Owner of Cooper CPA Group

Estate Planning Tax Expert

Founder & Managing Partner, Cooper CPA Group

More than 40 years of public accounting experience

Focuses on tax planning and compliance for individuals, business owners, and closely held companies

Advises on asset structuring, ownership arrangements, and long-term tax implications

Extensive experience supporting business succession and wealth transfer planning

Former professional experience with KPMG and in executive roles at publicly traded companies

AARON BALL, Owner of Ball PLLC

Estate Planning Attorney

Founder, BALL PLLC

Corporate and transactional attorney focused on estate planning–related legal matters

Advises business owners, entrepreneurs, and private companies

Experience in business succession planning, ownership transfers, and asset structuring

Licensed to practice law in Texas and the United Kingdom

Connect with us

We genuinely value our clients and look forward to partnering with you on all your estate planning needs. Connect with us to discover how our team of advisors can support your next strategic move.